Sure, for many who own a home, you could remortgage they. There are many points to consider when obtaining a home loan. You should know off what you are getting yourself into just before you start considering how much you’ll need to pay. Lenders glance at the pursuing the affairs: The worth of your house. Simply how much do you wish to borrow? How good you really can afford to settle the mortgage? In which would you decide to if you take money?

You should try to rating while the high an enthusiastic LTV that you can since if you might be lucky enough to get increased LTV following your own interest might be less than if perhaps you were delivering a lowered LTV. Along with, the greater the newest LTV, a lot more likely it is that you will be approved getting good larger mortgage. Your very own situations and you may everything you want to create for the currency will establish if your qualify for a higher americash loans Aguilar LTV or maybe not. → Read more

A statement out-of Allege to possess Arms means the lending company went to judge to begin with the procedure in order to repossess your house.

5. The financial institution Features A judgement

This new Statement away from Claim should be served you (basically given to you individually or remaining in your presence) that can feature a good Find to help you Occupier that’s sent in case you can find renters lifestyle here.

- You might however lodge from inside the AFCA to own adversity or other complaints (for example reckless credit or if you have been pressed on the a loan) up until truth be told there a view against you. That is totally free, and certainly will place the judge step to the keep when you find yourself AFCA appears to your criticism; otherwise

- You could potentially document a protection in judge. A protection is generally that you may never afford the costs, or you was unfairly stressed to the financing (such as for example. nearest and dearest violence or economic abuse). Get legal services first going to court was high-risk and you might end up expenses one other side’s judge and judge can cost you for many who clean out otherwise one thing fails

- You can certainly do nothing. Immediately following twenty-eight weeks seats, the lender can get a wisdom and you may relocate to repossess the fresh new family and pursue the complete number due

You ought to get legal counsel quickly!

The lending company can now query the fresh new legal to send the latest Sheriff (a police whom enforces legal purchases) to switch this new locks to your house and give new property on them. → Read more

The newest USDA home loan program provides reasonable financing so you’re able to reasonable-to-reasonable income homebuyers. Minimal borrowing from the bank being qualified rating USDA-approved loan providers want can vary and you will credit scores can affect the fresh new acceptance procedure. Yet not, the fresh USDA does not have a $600 loan same day hard and fast credit score specifications, very individuals having lowest results may still be eligible to help you be considered to have an excellent USDA-backed financial.

Accepted USDA loan lenders usually want the very least credit rating out-of about 640 to find a great USDA financial. But not, brand new USDA does not have any a minimum credit score, thus borrowers having results below 640 can still be eligible for a good USDA-backed financial.

In the event your credit rating was lower than 640, there’s nevertheless guarantee. The loan will simply have to go thanks to guide USDA underwriting, and need compensate which have the lowest financial obligation-to-income ratio, a substantial bank account, or other monetary issues that decrease your exposure once the a debtor.

How come really loan providers wanted a beneficial 640 credit rating to have USDA loans?

Loan providers like to make use of the USDA Guaranteed Underwriting Program (GUS) for a powerful, streamlined underwriting procedure. GUS analyzes the chance and eligibility as the a borrower using a good scorecard.

Automatic GUS acceptance need you to definitely have a credit history off 640 or maybe more with no the federal judgments or tall delinquencies. → Read more

Of a lot or most of the facts listed here are from our partners that pay us a percentage. It’s how exactly we make money. However, our very own article integrity ensures our experts’ viewpoints commonly influenced by compensation. Terms get connect with even offers noted on this site.

When you find yourself wishing to purchase a house into the California, you’ll need to check out the most useful financial pricing statewide. Doing your research which have multiple mortgage brokers increase your chances of obtaining a lot and a lower monthly payment in your mortgage for just what could well be decades. → Read more

The new credit craft typically has a primary-title negative impact on your credit score. Should you decide get the new borrowing or take into the additional obligations, credit-scoring expertise determine your greater risk to be able to blow your financial situation. Fico scores typically dip a little while when that occurs, however, rebound within this a few months providing you keep with their debts. New-borrowing passion is also contribute up to ten% of one’s complete credit history.

Numerous credit membership encourages credit-get developments. New https://www.paydayloansconnecticut.com/new-canaan FICO credit rating program is likely to prefer individuals with numerous borrowing from the bank membership, together with both rotating borrowing from the bank (profile such as playing cards where you can borrow on a paying limitation and come up with repayments from different numbers every month) and you can installment loans (elizabeth.grams., car and truck loans, mortgages and you will student loans, with place monthly payments and you will fixed payback attacks). → Read more

They never raise my maximum

They never increase my restriction. Now, my personal equilibrium is $0 to help you $fifteen monthly, plenty of action to ensure that they’re regarding closing. If only I might provides went with a special providers, as i in earlier times had a problem with him or her on later 90’s early 2000’s incorrectly record my repayments since the later to holder right up late charges, even if I became giving him or her signature confirmation more than each week very early together with all the evidence away from you to presented to him or her. → Read more

You want one home. You are sure that you really can afford one to domestic. However the supplier as well as their agent haven’t any treatment for understand if or not you can afford it. And will most likely not need certainly to spend time talking about your if they have most other accredited, audience are actually curious. Perhaps the realtor your contact can’t be yes if you really can afford purchasing a property after all.

Once you discover preapproval, a home loan company is actually letting you know how much cash off a good household you might manage

In these times of have a tendency to-beautiful and competitive construction segments, need every virtue you will find when you need to end up being the effective bidder. → Read more

What you need to See

- In the event that Social Safeguards disability income is your simply source of income https://paydayloansconnecticut.com/mansfield-center/, you might still be capable of geting accepted to possess a mortgage

- Several government laws, like the Fair Houses Act and you can Equivalent Borrowing from the bank Possibility Work, ban loan providers out of discerning facing individuals with handicaps

- A disability loan is actually a personal loan familiar with shelter expenditures for the period ranging from trying to get regulators disability positives and qualifying for those masters

Content

To find a house is usually the most significant buy you’ll be able to create and another of one’s tenets of your own Western Fantasy. Even though some anyone you will assume that a disability helps it be difficult otherwise impossible to score a mortgage, those with disabilities provides an abundance of options for getting home financing.

Although your just revenue stream try regarding impairment pros, there are certain lenders you can get acknowledged to possess. Trying to get a home loan having a disability is really like other loan application. Individuals with disabilities may have access to a lot more info to carry homeownership contained in this closer started to or even to retrofit property to match an excellent disability.

What’s an impairment Financing?

According to the You.S. Centers having Condition Manage and you can Reduction, a handicap means any updates that will maximum good man or woman’s ability to carry out specific affairs and you can build relationships the world as much as her or him. Handicaps can come in many different shapes and forms, and are more than simply a listing of understood conditions. → Read more

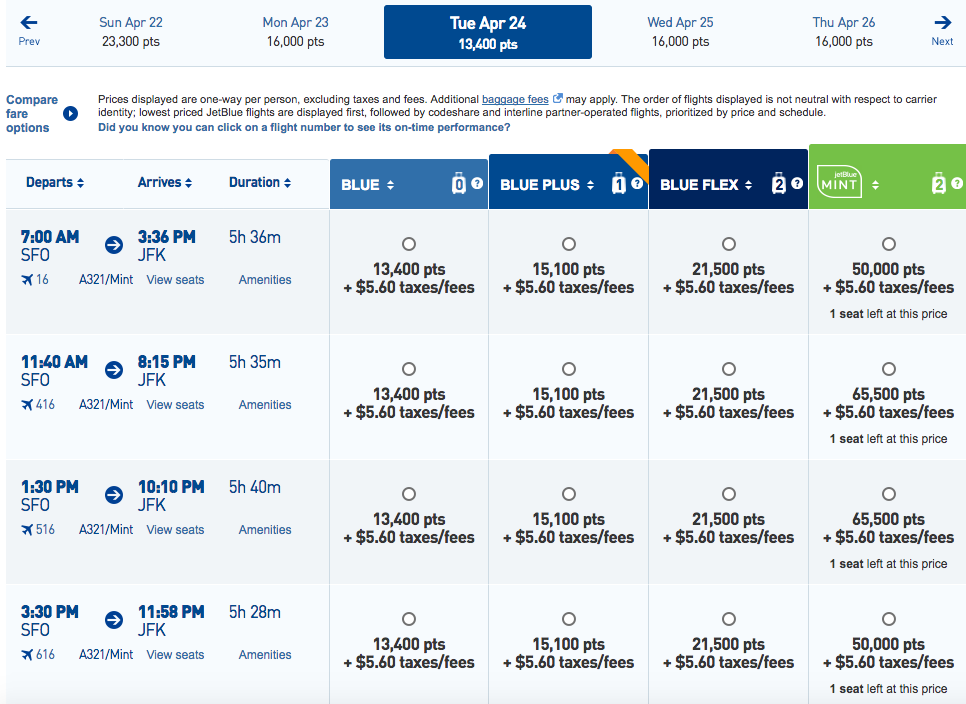

As the Bureau out-of Labor Analytics forecasts a lower request for travel companies by way of 2028 because of more people utilising the internet to book its reservations, you could potentially focus on considered group trips because a part hustle.

Such as for example, you could potentially work on the scheduling company you to definitely preparations and instructions group trips for people over 50, such lake cruise trips or any other common sites.

You’re not required to receive a licenses otherwise degree to-be a vacation broker, however, doing so could make you appear alot more reputable. If you do want to unlock a company, you will need new acceptance of different traveling and you will transport companies. But, you will have the flexibleness out of mode the newest times and you may charges for the services you provide.

Audio Teacher

Turn your skills to have to play a musical instrument toward income. Highlight songs courses for children, adults otherwise both. You could potentially will perform that-on-that tuition or you can facilitate group courses to make a lot more currency each hour. → Read more

Performing a decide to pay off their college loans makes it possible to escape debt shorter and acquire quicker from the much time work on.

step 1. Recognize how your education loan obligations often apply at your next

For many who have not come paying off your student loans but really, it could be hard to consider the way they you’ll perception your own income and you will lives. Will you have the ability to create enough money so you can safety your loan costs and help everyday living expenses?

You’ll get a few ideas regarding the repaying your own student loans of the lookin during the a student loan fees calculator eg 1st Monetary Lender USA’s Student loan Payment and you may Cost Calculator. Education loan fees hand calculators show off your estimated loan repayments considering your own interest and you can name duration of the borrowed funds. Such calculators make it easier to regulate how most of your coming income goes on the loan money, and can leave you good truth consider, preventing you against over-borrowing from the bank in school.

2. Begin making education loan repayments while you’re nonetheless at school

It sounds impossible to build financing repayments while you are nevertheless an university student and not earning a critical earnings. → Read more

Recent comments